In the medium term, this may provide a boost to digital-only financial intermediaries, and may accelerate the demise of brick-and-mortar financial shops.ĥ: Focus on inequality and financial inclusion

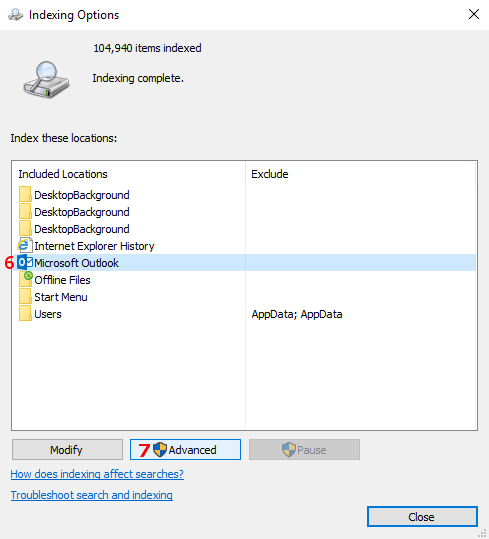

Radically speed up outlook 2016 indexing verification#

We expect identity verification via a video call to become accepted rapidly. Many people have had no other choice than to acquaint themselves with ways to do business digitally – ranging from video conferencing to exchanging documents securely by digital means, or paying contactless to minimise physical contact. On the retail end, we expect the adoption of digital finance technologies to accelerate post-Covid-19. That might change in the future.Ĥ: Faster adoption of digital interactions in retail In the EU, while there is an EU agency, there is no deep cooperation as in markets and finance, for example. Given that cybercrime knows no borders, it is best fought at the international level. To counter this threat, cybersecurity may be expected to move up the policymakers’ agenda.

We have to reckon with the possibility that bad actors use security gaps today to establish a presence, only to exploit this presence later on, when it suits them best. With resources reallocated to keeping the show on the road, this exposes businesses (and an already heavily burdened health care sector) to increased cybersecurity risks, such as ransomware attacks and data leaks, but also to things like fake news. The switch to working from home has stretched across corporate and national network infrastructures. in Europe were increasingly critical about bigtech before the pandemic struck, but also realise that major digital platforms have become an important part of daily life and are playing useful roles in locked down societies. How bigtech’s endeavours in finance fit the revised picture, remains to be seen. These international links were already critically scrutinised by authorities, a development that may intensify post-Covid-19. This ranges from financial ties to IT outsourcing and supervision. Finance has grown into a business with complex cross-border linkages. Countries with leading positions in the required technologies (think China and 5G) will be aware of their good negotiating position.Īuthorities realise digital platforms are playing useful roles in locked down societies. At the same time, governments have also been made acutely aware of the need for high quality communications infrastructure, e.g. A renewed debate on the division of labour between public and private sectors in finance will likely flare up, once the dust settles.īoth businesses and authorities will look for less complex cross-border supply lines and smaller foreign dependencies, as Covid-19 demonstrates their fragility, but also on national security grounds. Even in a best case scenario, it will take years to wind down this increased public role in finance and the broader economy. In finance, governments have quickly established huge guarantee schemes to see businesses through the crisis. Governments are now also looking into data, an area already identified as a strategic priority by the European Commission. Before Covid-19, the changing geopolitical landscape had already made policymakers aware of the strategic importance of vital domestic infrastructure, including communications and payments. The increased role of government in the economy and financial sector is likely to persist to some degree. The impact will be felt in six key areas. The COVID-19 pandemic will eventually pass, but not before disrupting vast swathes of the global economy and making its mark on digital finance.

0 kommentar(er)

0 kommentar(er)